Cashflow margin

The bigger the marginratio usually the better the return. Operating cash flow margin is a profitability ratio that is used to measure the amount of cash made from operating activities of a company as a percentage of net sales in a.

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Sckit02 Cash Flow Margin Formula Cash Flow from.

/GettyImages-490024232-ce77fc165c6147d2a4a6fa1c28824297.jpg)

. Operating cash flow tracks the cash flow generated by a business operations ignoring cash flow from investing or financing activities. Its operating margin is 5000001 million or 50. Youll need these numbers to determine your companys cash flow margin.

Operating Margin Example. Step 2 Calculate Net Revenue. Free cash flow margin measures the true economic profitability and cash-generating power of a business and is simply the number of pennies of FCF a company.

Free cash flow margin simply takes the FCF and compares it to a companys sales or revenue. Detailed cash flow statements for Microsoft MSFT including operating cash flow capex and free cash flow. Calculating the operating cash flow margin is a four-step process.

The cash flow margin reveals whether an organization can convert sales activities into liquid assets. Industry Screening reflects Cashflow Margin Quarterly. Gross margin in your retail store should be examined in two ways.

Now Honeywell is guiding for 4-7 annual organic sales growth and 40-60 basis points of margin expansion per year over the long haul. Once you have them plug them into this formula on your balance sheet. This is helpful in comparing the free cash situation of different companies on an.

The Cash Flow Margin measures how well company operations are at creating cash from sales of their products and services. However there is significant variance by industry. Calculating Free Cash Flow Margin The formula for.

It is the only way to analyze your cash flow. Step 3 Divide Operating Cash. Cash flow margin is basically a return of cash on sales.

For example say a company has an operating income of 500000 and net sales of 1 million. In turn that should drive. Operating Cash Flow Margin Cash Flow.

The Results may combine companies who have reported financial results in different quarters and could differ from other calculation. A companys cash flow margin is one measure of its profitability. As both a and as the amount.

The free cash flow margin for our sample of 16000 companies came in at a median average of 26 of sales between 2010 and 2015. Step 1 Calculate Cash Flow from Operating Activities. Cashflow Margin Quarterly ranking list of best performing Industries Sectors and Companies - CSIMarket.

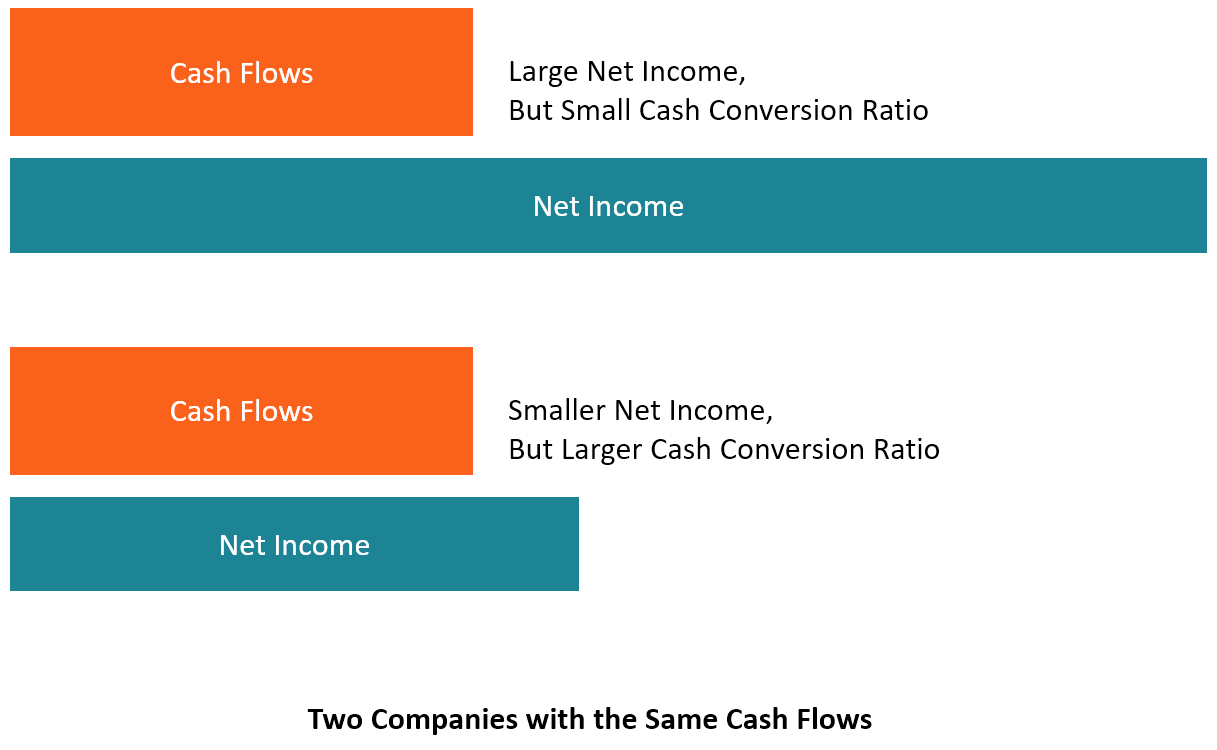

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Operating Cash Flow Margin Formula Calculator Updated 2022

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Statement Analysis Double Entry Bookkeeping

Incremental Cash Flow Definition Formula Calculation Examples

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Cash Flow Adequacy Ratio Formula And Calculator Excel Template

Mizvjx2w2abqnm

Summary Of Economic Margin Obrycki Resendes Abstract

/GettyImages-490024232-ce77fc165c6147d2a4a6fa1c28824297.jpg)

What S More Important Cash Flow Or Profits

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Profit Margin Formula And Ratio Calculator Excel Template

Mizvjx2w2abqnm

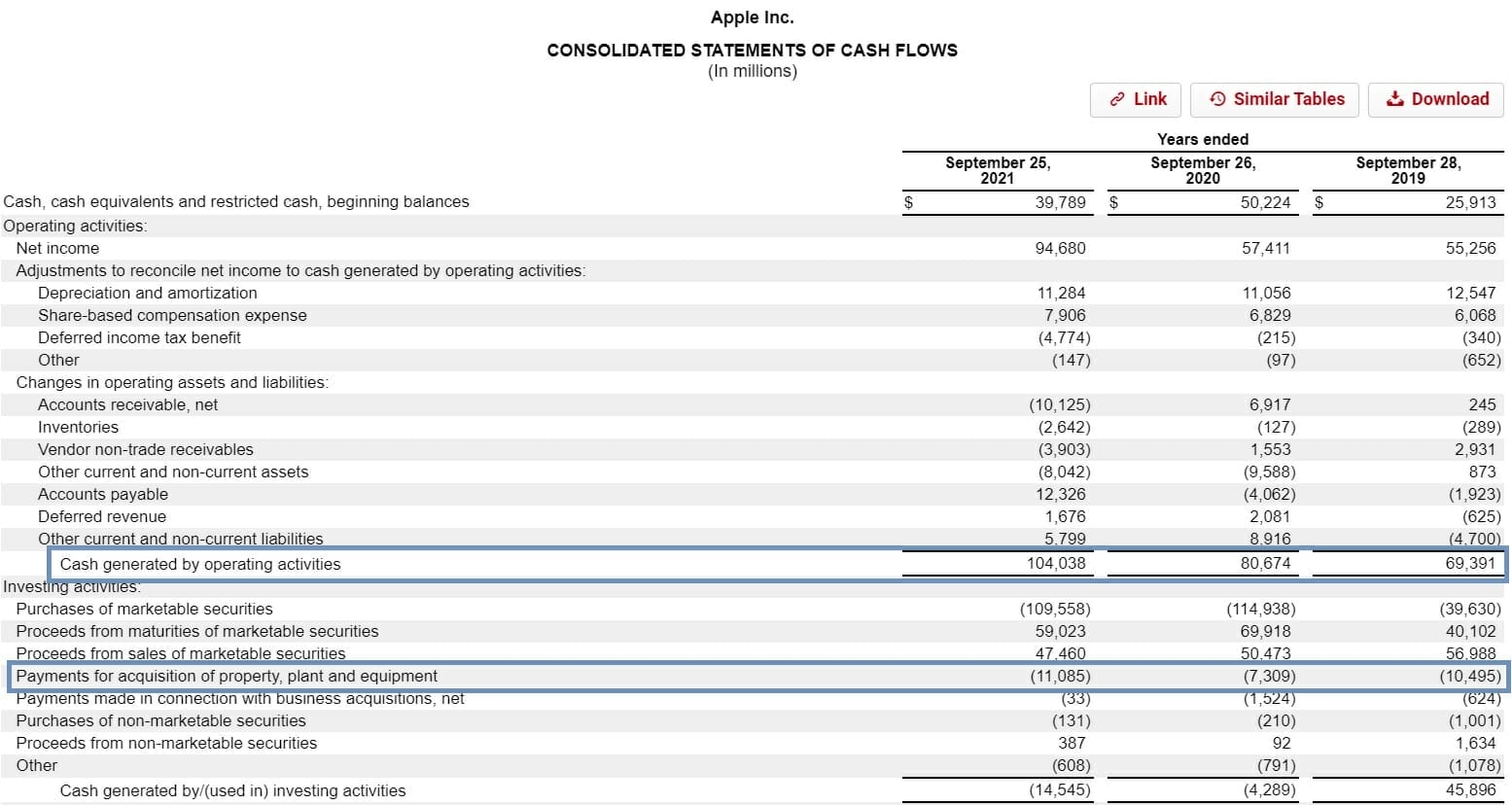

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial